Resilience

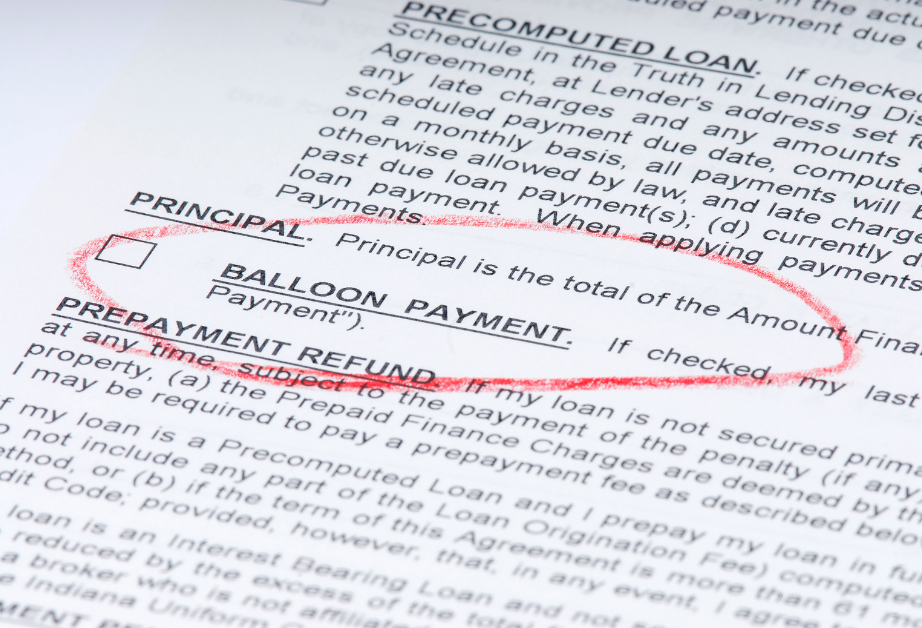

Main Street Lending Program: 70% Balloon Payments Coming Due in 2025

By Javier Jorge, EVP and Director of Government Guaranteed Lending, Locality Bank

If your business received a Main Street Lending Program (MSLP) loan during the height of the COVID-19 pandemic, there’s an urgent financial milestone on the horizon, and you need to be ready.

The vast majority of these loans, issued in 2020 as part of a special Federal Reserve emergency program, will mature in the fourth quarter of 2025. For most borrowers, that means a balloon payment of up to 70% of the loan’s principal is due by year’s end.

What Was the Main Street Lending Program?

The MSLP provided 5-year term loans to small and mid-sized businesses that needed liquidity during the pandemic. These loans were structured with deferred principal payments, requiring only interest in the early years. While that may have helped during uncertain times, it now leaves borrowers facing a steep repayment at maturity, typically the largest portion of the loan.

Why You Should Act Now

Waiting until Q4 2025 to address your balloon payment could create unnecessary financial pressure, especially as many lenders will be managing a flood of similar requests. Businesses that plan ahead will have more options and stronger negotiating power regarding refinancing.

At Locality Bank, we’re already working with businesses to refinance their MSLP loans into longer-term, more manageable structures through either government-guaranteed SBA loans or conventional financing.

Refinancing Options Include:

- ✅ SBA 7(a) and 504 loan programs

- ✅ Competitive conventional term loans

- ✅ Flexible repayment terms tailored to your cash flow

- ✅ Fast, local decision-making

Let’s Get Ahead of This Together

Reach out to explore your refinancing options before the year-end rush.

- 📞 Schedule a call with Javier Jorge, EVP and Director of Government Guaranteed Lending

- 📧 jjorge@localitybank.com

- 📱 727-432-0428

You May Also Like: “SBA Loan Roadmap: How to Get Approved & Funded Faster”

If you’re considering growing your business, securing financing may be part of your journey. Explore our guide on how to successfully navigate the SBA loan process, from application to funding.

Disclaimer: The information provided in this content is for general educational purposes only and does not constitute professional advice. Locality Bank makes no warranty, express or implied, nor assumes any legal liability or any responsibility for the accuracy, correctness, completeness, or any actions taken based on the information provided. Loan programs, terms, and requirements are subject to change. All loans are subject to credit approval.

.png)